There are multiple situations when you might need a home mortgage loan

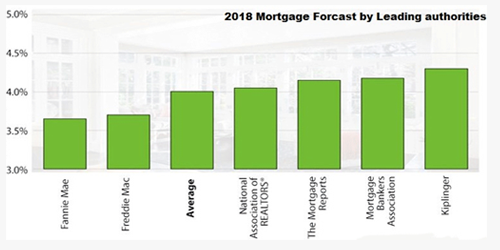

You might be a first home buyer in West Virginia, or you have moved in the state very recently or you might be one with a home equity in search of refinancing. So whatever be the scene, you need to educate yourself on pros and cons of WV mortgage loans, and the costs involved before you avail them. However, it is quite essential that you choose a loan that suits your financial situation and you will be able to retrieve with the loan cost in coming years. To know how loan costing is calculated, you must know current interest trend in West Virginia in which a mortgage broker will be your trusted alliance. A graph below will show you the 2018 predictions for mortgage rate in West Virginia.

Base categories of WV home mortgage loan

While looking for a home mortgage loan in the state, you will get acquainted with multiple loan patterns like home purchase loans, HELOC, refinance, 0 down loans, FHA and VA loans. Though they have different operation modules, all of these loans are subjected to two rates forms which are

Fixed rate of interest (FRM) : Traditionally the most common form of mortgage, with equally distributed EMIs through the loan period. It ensures stability to a mortgagor as the rates are locked from the time of loan inception. Though long tenure is preferred maximum, shorter options are also available, the choice rests on the buyer.

Adjustable rate of interest (ARM) : A great option for people with growing career, presently with low financial ability, but expecting higher income in coming years. Adjustable mortgages in its initial years frequently for 3, 5 or 7 years charge a low rate fixed EMI, henceforward, the rates will be revised at fixed intervals, based in the state's financial index.

Based on these rates the various loan options available in the state of West Virginia are

Home purchase loans

First mortgage home loan - The new buyers loans are subjected to this, with a choice of both FRM and ARM

Interest only mortgages : The initial EMIs will include the interest breakdowns only, the principal is added to the EMI henceforth, quite suitable for those with growing careers.

Jumbo loans : Loan amount exceeding the conforming loan limit of the state, generally used for making luxury purchases.

Home Equity loan : This loan as the name suggest solves credit requirement keeping home as equity. Loans namely

HELOC : The borrower is assured the maximum amount keeping his/her home as equity, which as to be returned on agreed term

Debt Consolidation : It allows you take a new loan to payoff multiple loans, with combined low interest.

Home improvement loans : It funds credit requirement needed for home renovation, of course with home equity.

Government Sponsored loans : Under this banner there are loans like FHA loan, VA loans which are subsidized by the U.S. Government to support home financing of lower and mid income groups.

Decoding procedure of home loan the approval

For getting a mortgage in West Virginia you need to find a mortgage lender in West Virginia and if you are a first-time buyer, you must tally your options of mortgage lender well before signing on. Calculate the charges that will be included in the loan amount. But with so many offers available in the market, the easiest way to choose the best deal is to make a comparison study. Hence, an experienced mortgage broker can lend you a helping hand in this comparison.

Why would you choose us

At MorrtgageLoanSpot we make the loan approval procedure for very customer an effortless, paperless procedure. Calculate your loan cost using our mortgage calculator, compare rates and offers from all the leading mortgage companies in West Virginia and then apply through us. As a trusted mortgage broker in WV, we will work to get your loan approved at least possible time, with you being in your comfort zone.

Quick Quote

Westvirginia Home Mortgage

Our Helpful Tools and Info

We have put together some helpful information and mortgage calculators to help answer any questions you might have.

Loan Types

Our complete list of loans along with their detailed description will help you decide which loan is good for you.

Calculators

We have put together some calculators to help you make sense of the numbers. They are all easy and fun to use.

Questions & Answers

Here we tried to answer the most important questions you may have. For more answers use our contact page form or call +1 (850) 733-2400