Know how interest is regulated in an economy

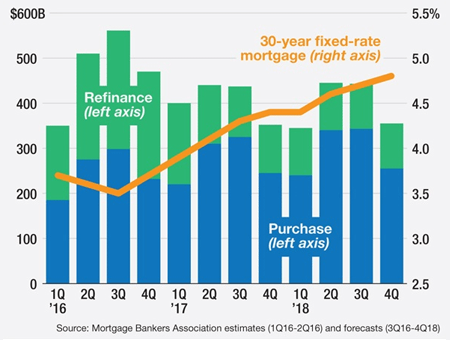

Every economy is affected by its financial changes and market upsurges directly. While in its growing phase, a state economy experiences higher rates; the rates show a steep fall during a recession. In West Virginia including other U.S states, the annual percentage rate (APR) is regulated by the Federal Reserve control. As per the predictions by Mortgage Banker Association and National Association of Realtors, the 2nd and 3rd quarter of 2018 will witness the rise in rates of both fixed rate mortgages and refinance in West Virginia. The chart below projects a growth chart of Refinance and home buying mortgages in the four quarters from 2016 to 2018.

Hence following these predictions, refinancing your home in West Virginia, in 2018 will be an advantageous proposition. The graph says that if the 1st and the 2nd quarter of 2018 do not witness drastic real estate valuation, yet with the rates on rising, refinancing in the 1st half of 2018 is advisable. Nevertheless, you can also expect better refinancing with lower rate based on your last refinancing or your primary loan issuing date. Hence the present West Virginia mortgage refinance rates are advantageous to every refinancer.

Key Factors Influencing Good Home Refinancing Rate

Present financial status : Your financial capabilities like credit score and debt to income ratio, highly influences your mortgage lender. A low credit score and high debt to income ratio represents a mortgager's low repayment ability and hence, subjected to higher interest rate and eventually higher EMIs. But with contrary eligibilities, you can be assured of low-interest rates.

Choice of loan options : The market is levied with multiple options for loan tenure and loan rate. While in loan tenure you can choose anything between 60 months to 40 years, it will also be your choice between adjustable rates and fixed rates of refinancing. For example for a short term, 15 years refinance, your return will be soon; but rates will be higher, as a mortgage lender in West Virginia will, be adjusting his profit in this small tenure. On the contrary, for 30 years your loan will be quite inexpensive for being distributed over such a long period.

Purchasing mortgage points : Lower rates can also be ensured with mortgage points which are: origination and discount points. A single point of both types accounts for 1% of the mortgaged property. Say; for a home value of $ 250,000, a single point will add $2500 as upfront cost, but your APR will be down by 1 %. Hence though you might need to pay an added upfront cost, you will be able to save a lot on overall loan repayment.

Loan to value ratio (L to V) : The ratio of the loan amount with the value of assessed property denotes L to V ratio. If your mortgaged property values $60,000 and you have borrowed $ 50,000, your L to V ratio will be 50%. Loan to value ratio accounting higher than 80% requires addition of mortgage insurance, which increases rates for home refinancing West Virginia.

Property to be mortgaged : West Virginia Refinance interest rates are also influenced by kind of property you will be refinancing. As according to eminent financial advisors refinancing with condominiums might charge 0.125 to 0.25 % higher rate than independent homes or bungalows.

Addition of Supplementary Charges Increases Rates

There are payment areas that a customer needs to cover like escrow accounts, final settlement, property assessment and underwriter and title insurance fees all under the banner of closing costs. Closing costs of refinancing in WV hence adds up to the overall loan cost. However, if a mortgage lender in West Virginia is offering no-cost loans check for any other hidden charges as well.

Selecting the right mortgage lender in WV

So if you have checked all the above concerns you will be left with selecting the mortgage lender. Once you start looking for re-finance options, you will find hordes of WV refinance mortgage lenders, with multiple offers from them, so chances are that you might get confused. Hence you must compare every refinance options before you sign in. A mortgage broker in WV can rightly assist you in this comparison and make the final selection.

Why should you choose MortgageLoanSpot

As a reliable West Virginian mortgage broker, our primary motto rests on securing the best Mortgage refinance rate in West Virginia for you. At MortgageLoanSpot, our resources will assist your lender comparison. Get our refinance loan calculators work on calculating your loan values; access your lender directory; choose to refinance customized to your needs. Applying to us, you will ensure yourself a hassle-free, paperless, quick approval at ease; at least possible time.

Quick Quote

Westvirginia Home Mortgage Refinance

Our Helpful Tools and Info

We have put together some helpful information and mortgage calculators to help answer any questions you might have.

Loan Types

Our complete list of loans along with their detailed description will help you decide which loan is good for you.

Calculators

We have put together some calculators to help you make sense of the numbers. They are all easy and fun to use.

Questions & Answers

Here we tried to answer the most important questions you may have. For more answers use our contact page form or call +1 (850) 733-2400